Long-Term Financing For Real Estate And Equipment

In partnership with a bank lender, the Small Business Administration (SBA) 504 Program provides financing for fixed assets, real estate, machinery, and equipment. Whether making the move from leased space to owning a building; expanding or improving operations; constructing a new building for business operations, or purchasing new equipment, the 504 loan can be a powerful financing tool.

A few examples of past projects include:

- Manufacturing Operations and Warehouses

- Hotels

- Self-Storage Facilities

- Restaurants and Bakeries

- Childcare Facilities

- Car Dealerships and Repair Shops

- Gas Stations and Convenience Stores

- Doctors, Dentists, Optometrist, and Veterinarian offices

- Grocery Stores

Why Indiana Statewide CDC

Indiana Statewide CDC has been providing loans through the 504 program for over 40 years, assisting more than 1,700 companies. Indiana Statewide CDC is consistently one of the leading providers of 504 loans in the country. We have an experienced staff that is focused on providing friendly, efficient, and timely service to assist both lenders and borrowers in achieving their goals.

How It Works

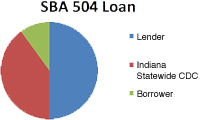

The SBA 504 program is a partnership between a bank lender, providing a conventional loan for 50% of the project, and Indiana Statewide CDC (SBA), typically providing 40% of the financing. The borrower is responsible for the remaining 10%.

The SBA 504 Loan Offers Great Terms

- Long term fixed rate:

20 or 25 years for real estate

10 years for equipment

- Low down payment: 10% in most cases

- Typically below market interest rate

- Most fees are financed into the loan

Benefits of the 504 Program

For the Borrower

- Up to 90% financing for a project when only 70% - 80% is typically available through conventional financing.

- A lower down payment directly resulting in the preservation of working capital.

- A longer term which translates into lower payments, reducing the burden on cash flow.

- A portion of the project financed with a fixed rate providing protection against interest rate fluctuation.

For the Lender

- 50% loan to value ratio minimizes collateral risk.

- Smaller lenders have an opportunity to assist borrowers with larger projects than they could on their own.

- Lenders can limit exposure to certain industries.

- Allows a lender to leverage lending capacity and assist more borrowers.

- Lenders can help borrowers with projects that they typically would not be able to finance.

- No ongoing reporting requirements to the SBA

- CRA Credits

Does Your Project Fit?

Eligible Use Of Funds

- Land

- Existing Building

- New Construction

- Fixed Assets from Business Acquisition

- Building Expansion / Renovation

- Long-Term Equipment

- Professional Fees

- Lender's Interim Points & Interest

- Debt Refinance (Expansion Projects - debt refi may not exceed 100% of the new expansion costs)

Ineligible Use Of Funds

- Working Capital

- Inventory

- Goodwill Assets from Business Acquisition

- Franchise Fees

- Tenant Improvements

Maximum Loan (SBA Portion)

- $5.0 Million (Typical Project)

- $5.5 Million (Manufacturers)

- $5.5 Million (If Certain Energy Public Policy Goals Are Met)

- No Maximum Limit Placed on Participating Lender's Loan Portion

Borrower's Injection

- 10% in Most Cases

- 15% for Start-Up Businesses (Less Than Two Years In Operation) or Special-Purpose Properties

- 20% if The Project is Both a Start-Up and Special-Purpose Property

- Equipment-Only Loans may Qualify with 10% or 15% Injection

Occupancy

- 51% For Existing Facilities / Building (renovations and expansions are eligible)

- 60% for Ground-Up Construction Projects (must occupy 80% within 10 years)

If You Are Interested In An SBA 504 Loan Through Indiana Statewide CDC

For the Borrower

Talk to your Lender about using the 504 Program or contact us to answer any questions.

For the Lender

Contact our office so that we can discuss the project and/or schedule a meeting with you and your borrower in person.

If you have additional questions, contact us at 317-844-9810

If you have additional questions, contact us at 317-844-9810

Please do not forward non-public information through this website.